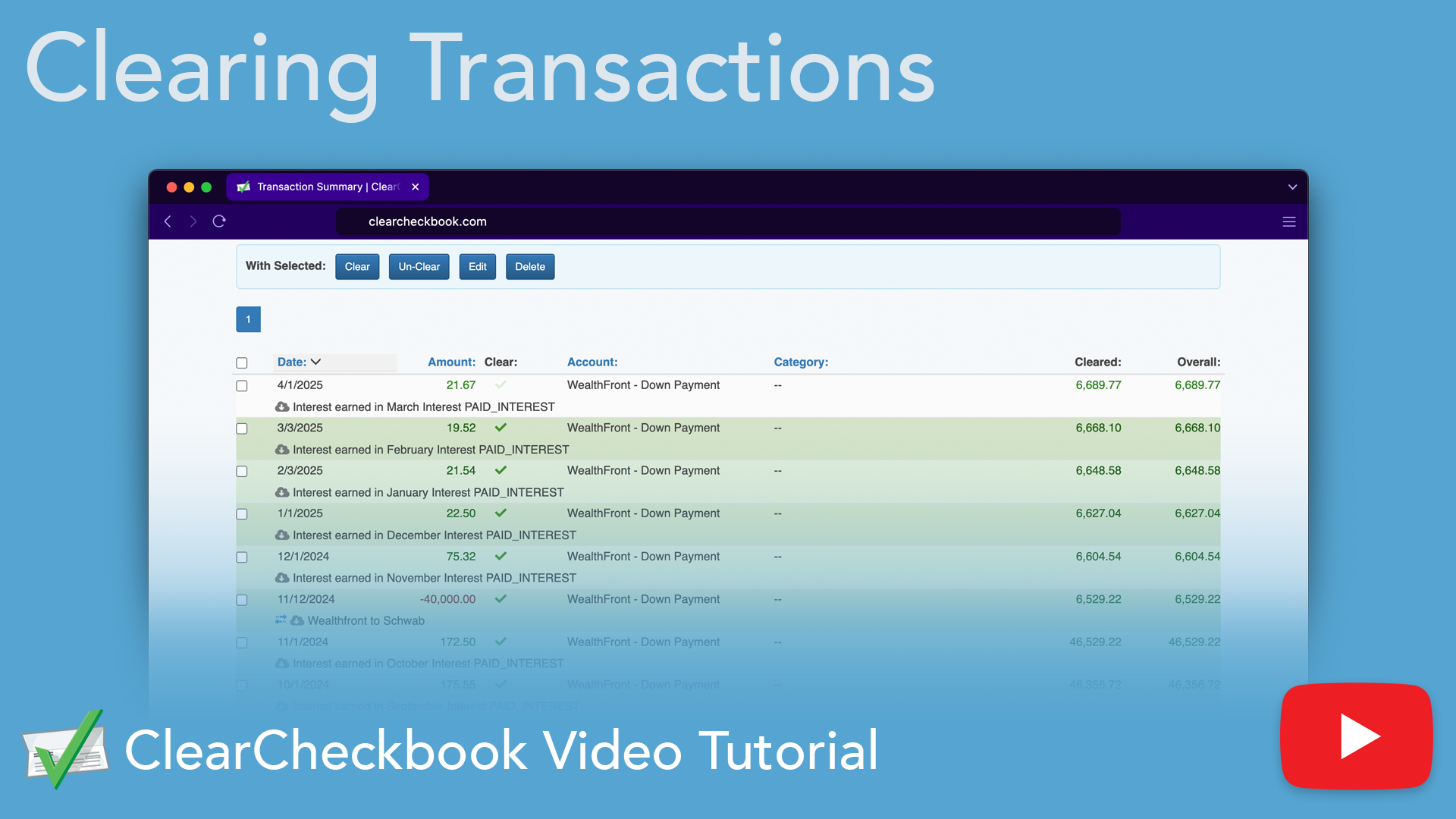

Clearing is the process of selecting transactions that appear on your bank statement and marking them as Cleared. This will update the Cleared balance which should match your bank statement. The full tutorial linked above covers in detail the entire process.

Learn more about using the Clearing method of reconciliation in our tutorial video:

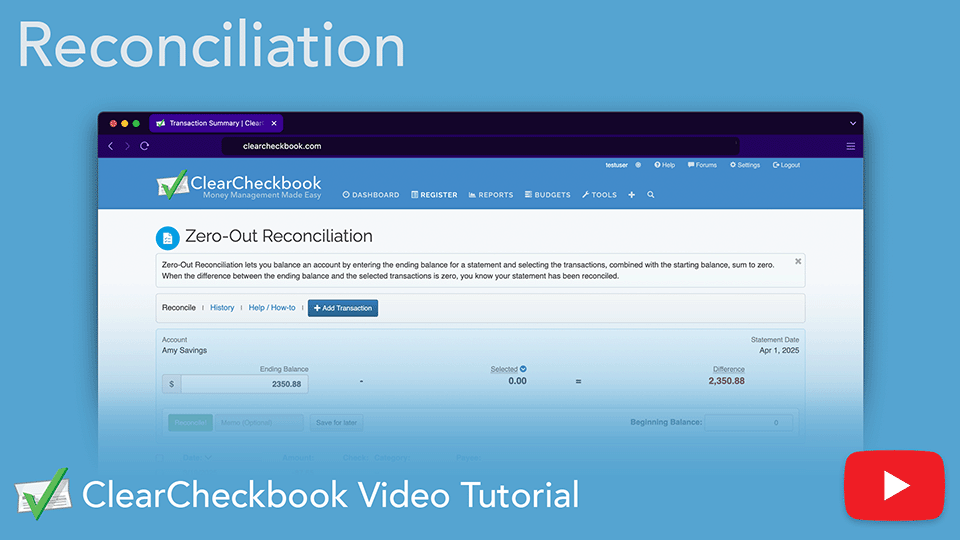

Direct link to YouTubeZero-Out Reconciliation is a tool for ClearCheckbook Premium members that lets you balance an account by entering the ending balance for a statement and selecting the transactions, combined with the starting balance, which should sum to zero. When the difference between the ending balance and the selected transactions is zero, you know your statement has been reconciled.

You can find the Zero-Out reconciliation tool from the Transaction Register by clicking on the Reconcile link in the Register Options box.

Once you've reconciled an account, you can view a history of your reconciliations by clicking on the History link at the top of the Reconciliation tool.

To view the details for the statment, click on the number in the # Transactions column. The statement history shows which account, the statement date, beginning and ending balances and the list of transactions for that statement.

You can edit the statement date or delete the entire reconciliation by clicking either the or icons.

Note: Only uncleared transactions will appear in the Reconciliation tool. This is because cleared transactions are already seen as reconciled in our system. If you mark transactions as cleared outside of the Reconciliation tool, they will not appear when you open the reconciliation tool.

If you have transaction syncing enabled and your transactions are automatically marked as cleared when your bank marks them as posted, you can turn that off in the Settings Syncing Transactions Synced Transaction Settings page, specifically the option for Set posted transactions as cleared?.

Learn more about using the Zero-Out method of reconciliation in our tutorial video:

Direct link to YouTube