The Debt Snowball method is a debt reduction plan that has you pay off your lowest balances first and then roll the money from those payments into your higher balances after they're paid off. For more information on the debt snowball plan, check out the Wikipedia article.

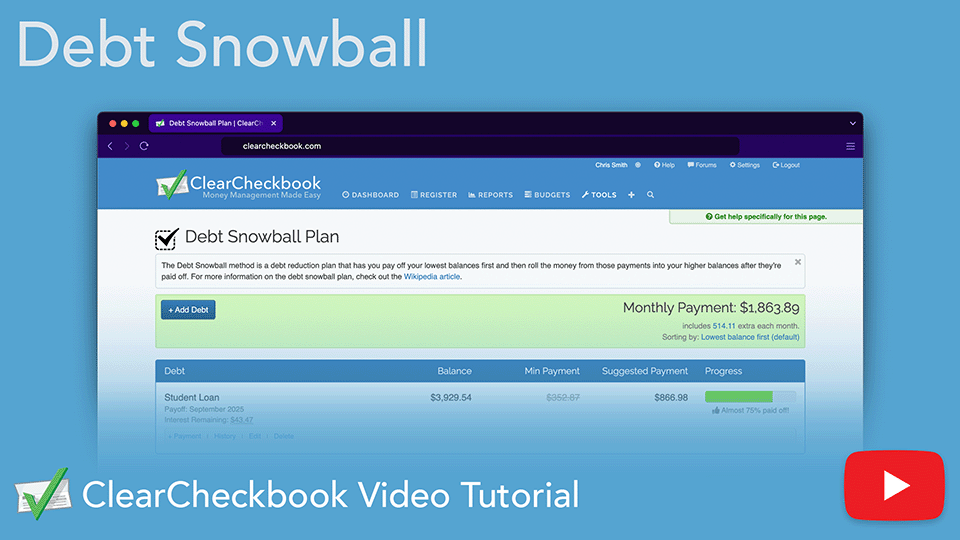

You can find the Bill Tracker by clicking on Tools at the top of the page, then click on the Debt Snowball link.The Debt Snowball tool is broken up into a few different sections which are shown and explained below.

| Number | Description |

|---|---|

1 |

You can add new debts to the tool by clicking on the + Add Debt button. |

2 |

This section shows the total monthly payment due, based on minimum payments and any additional money you pay each month. |

3 |

The list of debts sorted by your preferred sorting method. |

4 |

If you have any completed debts they are shown here. The amounts from these debts are also used when determining the Suggested Payment. |

To add a new debt, click the blue + Add Debt link at the top of the debt list. This will bring up a form where you can enter the details about the debt.

The fields in the Add Debt form are explained in the table below.

| Field | Description |

|---|---|

Debt Name |

You can give your debt any kind of name you want. We recommend giving it a descriptive name so you know what the debt is. |

Current Balance |

If you're adding a brand new debt, this is the total amount owed for the debt. If you've already been making payments to the debt, enter the current balance here. You can edit the original loan amount by editing the debt. |

Minimum Payment |

This is the minimum amount you're required to pay to the debt each month without going deliquent. |

Interest Rate |

Enter the current interest rate on the debt. |

The way you sort your debts determines which debts will be paid off first. You can change the sorting method by clicking on the link next to Sorting by: at the top of the debt list.

When you click on the Sorting by: method a new form will appear that lets you select which method you prefer.

There are four sorting options which are described in the table below.

| Option | Description |

|---|---|

Lowest balance first |

This is the default sorting method. It sorts your debts so you pay off the lowest balance first. |

Highest balance first |

This sorting method has you pay off your highest balances first, working toward your lowest balances. |

Lowest interest rate first |

This sorting method pays off debts with the lowest interest rate first. |

Highest interest rate first |

This sorting method pays off debts with the highest interest rate first. |

You can see how the various sorting methods will affect how quickly your debts will be paid and how much interest you will end up paying over the course of the debts. To find this information, click on the Which sort method is best for me? link.

This table shows you the sorting method, the date all of your debts will be paid and how much total interest you will pay. You can use this information to determine which sorting method is best for you.

If you have any debts that have been paid off, the minimum payment from those debts will be added to your suggested payment. You can also let the system know of any additional money you'll contribute toward principal each month so we can properly calculate the snowball.

To change the additional monthly payment, click on the amount link in the includes XXX extra each month line.

If you enter an additional payment or have completed debts, the Suggested Payment column will show the recommended amount to pay toward your primary debt.

The debt list is sorted by your preferred sorting method. If you have multiple debts, the primary debt is listed first and had a darker blue header. This primary debt is what you will aim to pay off first.

Each debt has information shown which will help you know when the debt will be paid, how much interest is remaining, your progress and more. The various data fields are explained in the table below.

| Field | Description |

|---|---|

Debt Name |

The name of the debt. |

Balance |

How much principal you have left to pay on this debt. |

Min Payment |

The minimum payment that must be made for this debt. |

Suggested Payment |

For the primary debt, this is what you should be paying based on any completed debts or additional monthly payment amounts. |

Progress |

A progress bar that shows how close you are to paying off the debt. |

Payoff |

This is the date you should have the debt paid off if you follow the suggested payment amount. |

Interest Remaining |

This is how much interest you have left to pay if you follow the suggested payment amount. |

Action bar |

This bar below the debt information has links for + Payment, History, Edit and Delete. Each of these are explained in more detail in their own sections below. |

You can view your Payoff Table by clicking the View Full Payoff Table link located under your list of debts. The payoff table gives information about when each debt will be paid off and how the snowball will affect each debt. You can also make some adjustments to see how different variables will affect how quickly you can pay off your debts.

When you click the View Full Payoff Table link, you'll see the total debt amount and how much the snowball method is saving you compared to a non-snowball payoff method. Below that is a table showing each month and how the snowball method affects the overall debt balance. When a debt is paid off, the amount paid to that debt is applied to the next debt per your sorting settings.

We provide some adjustment options to the payoff table that can help you see how different variables will affect how quickly your debts will be paid off. You can find these adjustments by clicking on the slider icon shown in the screenshot below.

The options available for modifying the payoff table include: changing how much additional monthly payment is being applied, adding a one-time payment and selecting which debts will snowball. By modifying these options, you can see how your payoff table will be affected without having to make permanent changes to your debts.

To add a payment to a debt, click on the + Payment link as shown below.

When you click the + Payment link a new form will appear where you can enter the amount you paid toward the debt and an optional Extra field where you can enter any extra payments towards principal. Each monthly field will be pre-populated with the suggested payment amount (or the minimum payment if you aren't paying your primary debt).

Save button next to the month you made the payment for, that payment will be recorded and the debt information will be updated next time you reload the page. You can view a history of your debt payments by clicking on the History link in the actions bar.

The payment history consists of a table that lists all of your payments with the month and amount paid. Below the table is a box that shows how much you've paid toward principal and how much toward interest over the duration of the debt.

If you need to delete a debt payment, you can click the red icon.To edit a debt, click on the Edit link in the action bar for the debt you want to modify. This will bring up the Edit Debt form at the top of the debt list.

The form that appears looks similar to the Add Debt form except it has the addition of a Starting Balance field.

Starting Balance field is where you can put the actual starting balance of the debt at time of inception. For example, if you opened a mortgage 10 years ago but are just now adding it to ClearCheckbook, you can put the initial loan amount in the Starting Balance field. This will help us better track the payment progress percent. If you need to delete a debt, you can do that by clicking the Delete link in the action bar.

When a debt gets paid off it moves down to the Completed Debts section. The amount from the paid debt is used when calculating the Suggested Payment for the primary debt. If you don't want the completed debt to be part of the Suggested Payment and the snowball calculations you can delete it by clicking the icon.

Our Debt Snowball tool helps you visualize and accelerate your debt payoff using the proven snowball method. Add your debts, track progress, adjust payment strategies, and see how much time and interest you can save. Stay motivated with clear insights and a personalized plan to become debt-free faster.

Direct link to YouTube