We've been testing ClearCheckbook version 5 internally for a while and now we're ready to expand the number of testers trying it out!

If you're interested in being one of the first people to use the new version of ClearCheckbook, please let us know either by submitting a 'Contact Us' message from the bottom right side of the page or by replying to this thread. ClearCheckbook v5 is currently using the live database so you'll be able to see all of your actual data which makes the testing process a lot easier and gives you a better idea how the site behaves.ClearCheckbook has been growing and is quickly reaching the limits of our current server setup. To address this, we're doubling the memory for our database and increasing the number of CPUs that serve the site.

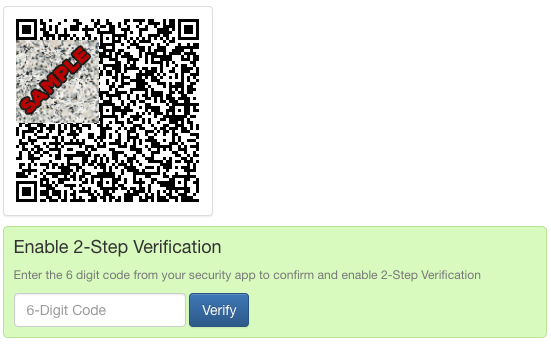

With the increased traffic we've been seeing, the site has had started exhausting its current resources. This expresses itself by the site running extremely slow or showing a timeout warning. We're doubling the amount of memory given to our database and are dialing in the increased number of CPUs required to help serve the site as quickly as possible.We've added an extra layer of protection to your login with 2-Step Verification

2-Step Verification, or Multi-factor authentication (MFA), is a widely used method for securing your data online. The ClearCheckbook MFA is opt-in, meaning you can enable this if you'd like to add an extra level of security to your login.

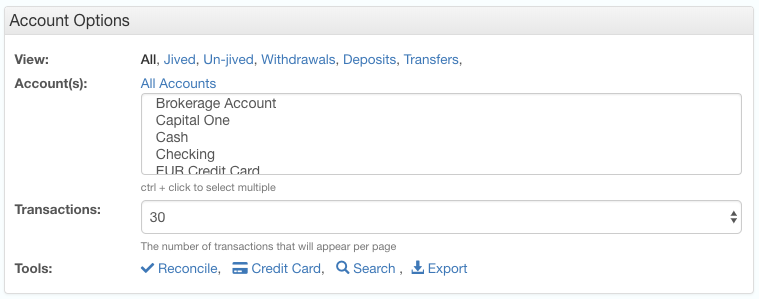

We've added a new reconciliation tool if Jiving isn't for you.

While we still stand behind ClearCheckbook's established reconciliation tool, Jiving, we've had many users want a more traditional way to reconcile their bank statements by zeroing out to their ending balance by selecting the transactions that appear on their statement.