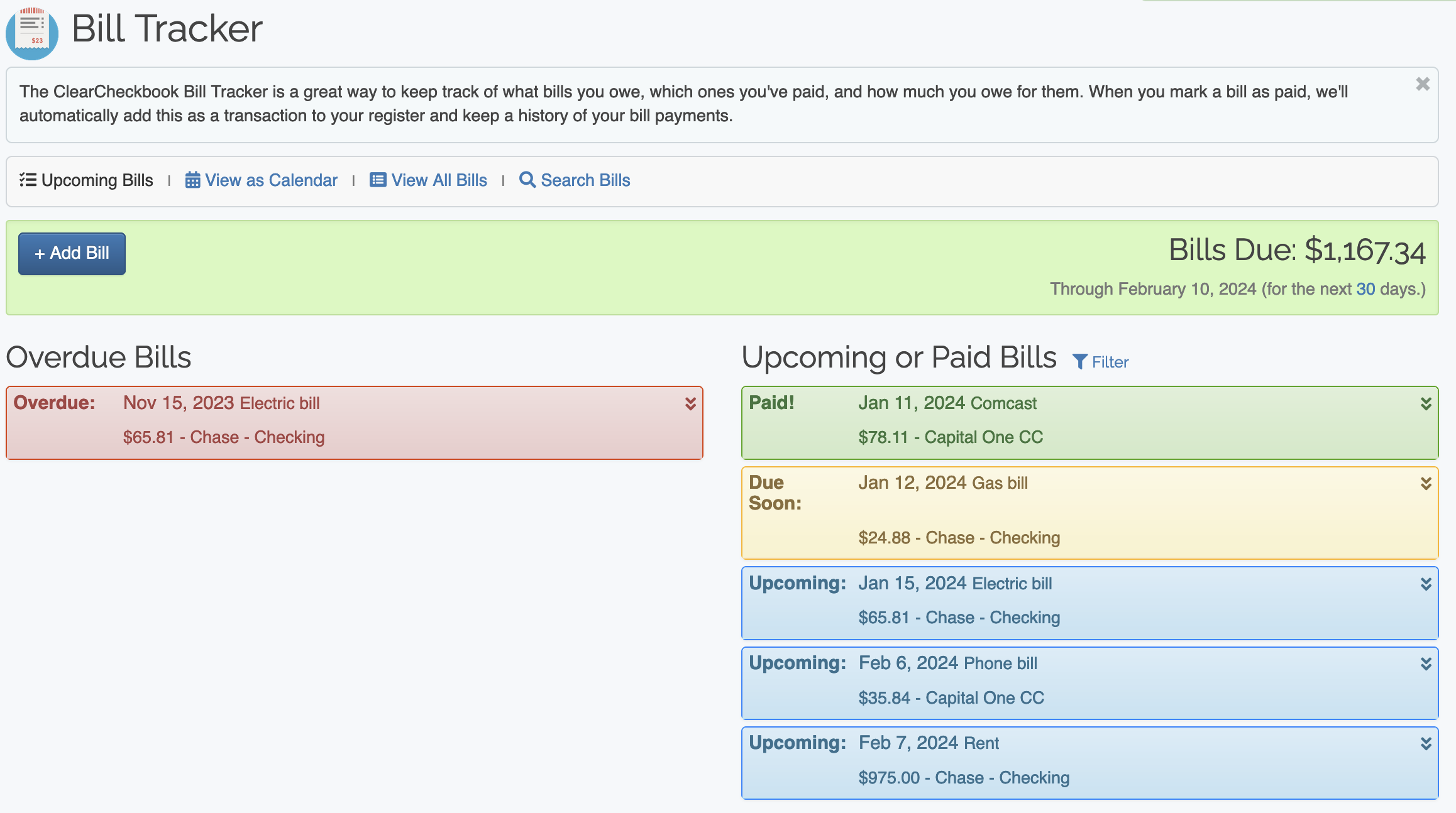

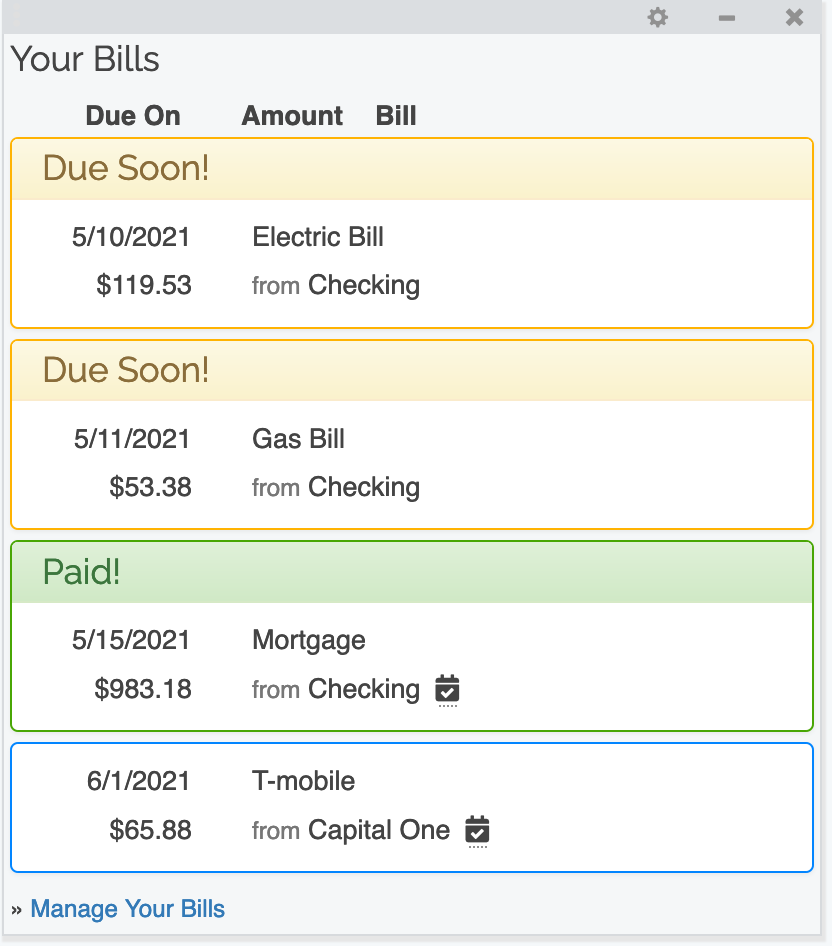

The Bill Tracker got a slight user interface update and we also added a new "Autopay" flag when adding and editing bills.

We've added a few updates to the ClearCheckbook website and apps over the last month that you might have missed. These updates include a Crypto Portfolio and Retirement Calculator for the website. We also added Account Groups to both the iOS and Android apps.

We received the following notification from our transaction processor, Plaid, in regards to transaction syncing:

"In anticipation of upcoming government relief funds being distributed at scale, we are proactively reducing our transaction update interval to alleviate pressure on bank infrastructure. During this period of high traffic, some institutions may also experience elevated error rates. We will update this message when we revert back to normal."If you notice your transactions not syncing as fast as they normally do, it's probably due to the above notice.

We just released our first big update of 2021 which includes over 20 new features, tweaks and bug fixes. The biggest new feature is the ability to connect to your bank and have your transactions automatically synced to ClearCheckbook!

Connecting with Financial InstitutionsSearch Institutions form on our Syncing with Financial Institutions knowledge base page. More information about how to set up ClearCheckbook to sync with your bank can be found on our Connecting to your Bank knowledge base article.n/a in the Budgets list. Now they are hidden from the list.